Resource Center

Stay up-to-date with Synergos Technologies’s current blog, news, white papers, success stories, and more!

How Quarterly Demographic Data Captured the Post-Fire Decline in Palisades, CA

How Quarterly Demographic Data Captured the Post-Fire Decline in Palisades, CA How Quarterly Demographic Data Captured the Post-Fire Decline in Palisades, CA The Palisades region

The Quantum Customer

The Quantum Customer The Quantum Customer The Quantum Customer: Why Pinning Them Down Might Make You Wrong Let’s play a little thought experiment. In quantum

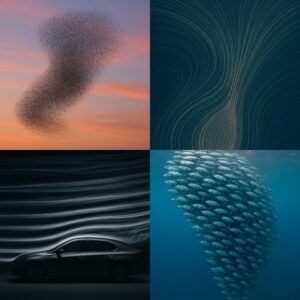

The Predictable Pulse of Community

The Predictable Pulse of Community The Predictable Pulse of Community If you’ve ever seen a flock of starlings swirl across the sky, or smoke trace

Housing Affordability in a Shifting Economy

Housing Affordability in a Shifting Economy Housing Affordability in a Shifting Economy Our STI Market Reports give decision-makers more than just housing prices—they reveal

Aged Markets in Focus

Aged Markets in Focus Aged Markets in Focus This week we’re examining three aged communities with a high proportion of Social Security recipients:

Mexico’s Labor Force Participation 2023

Mexico’s Heartbeat – 2023 Understanding labor force participation in Mexico Mexico’s Heartbeat – 2023 Understanding labor force participation in Mexico. We’re entering our second year

Resource Center

Stay up-to-date with Synergos Technologies’s current blog, news, white papers, success stories, and more!

Resource Center Categories

How Quarterly Demographic Data Captured the Post-Fire Decline in Palisades, CA

How Quarterly Demographic Data Captured the Post-Fire Decline in Palisades, CA How Quarterly Demographic Data Captured the Post-Fire Decline in Palisades, CA The Palisades region

The Quantum Customer

The Quantum Customer The Quantum Customer The Quantum Customer: Why Pinning Them Down Might Make You Wrong Let’s play a little thought experiment. In quantum

The Predictable Pulse of Community

The Predictable Pulse of Community The Predictable Pulse of Community If you’ve ever seen a flock of starlings swirl across the sky, or smoke trace

Housing Affordability in a Shifting Economy

Housing Affordability in a Shifting Economy Housing Affordability in a Shifting Economy Our STI Market Reports give decision-makers more than just housing prices—they reveal

Aged Markets in Focus

Aged Markets in Focus Aged Markets in Focus This week we’re examining three aged communities with a high proportion of Social Security recipients:

Mexico’s Labor Force Participation 2023

Mexico’s Heartbeat – 2023 Understanding labor force participation in Mexico Mexico’s Heartbeat – 2023 Understanding labor force participation in Mexico. We’re entering our second year

Top 29 Market Report

Top 29 Market Report – 2023 Exploring the top 29 markets experiencing the most growth in the US. Top 29 Market Report Exploring the top

Demographic Collapse?

Are We Headed Towards a Demographic Collapse? The rapid decline in birth rates globally deserves our attention. Let’s explore how the numbers stack up. Are

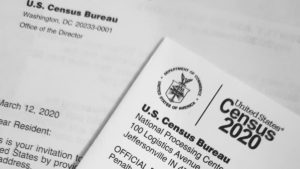

The Updated Synergos 2020 Census Plan

What you can expect from Synergos Technologies in 2023, and how we’re dealing with a new Census 2020 release plan.

Average Home Values Since 2007

Average Home Values Since 2007 How has the housing market performed since the 2007 financial crisis? Average Home Values Since 2007 How has the housing

GDP per Capita in Top Growth Markets

GDP per capita in top growth markets like Austin and Boise is either slowly increasing, or has not increased at all.

Lifestyle Segments Fueling Top Growth Markets

We released the top 10 growth markets report earlier in 2021. Now find out which lifestyle segments are fueling that growth using STI: LandScape™.